How Much Is Personal Exemption For 2025

How Much Is Personal Exemption For 2025. (returns normally filed in 2025) standard deduction amounts increased between $750 and $1,500 from 2025. The standard deduction for a single person will go up from $13,850 in 2025 to $14,600 in 2025, an increase of 5.4%.

The personal exemption for 2025 remains at $0 (eliminating the personal exemption was part of the tax cuts and jobs act of 2017 (tcja). Here’s how your personal tax rules can be affected;

Starting july 1, 2025, people earning less than $43,888 per year, or $844 per week, would be eligible for overtime pay.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, How much is the standard deduction for 2025? 1, 2025, that salary threshold would.

Homestead exemption form Fill out & sign online DocHub, Returns on post office fd and nsc if you. The standard deduction for a single person will go up from $13,850 in 2025 to $14,600 in 2025, an increase of 5.4%.

2025 Federal Personal Exemption Clem Melita, 3 lacs, reduced surcharge rate from 37% to 25% for income exceeding rs. These rates apply to your taxable income.

Personal Tax Relief 2025 L & Co Accountants, 5 crores, 100% tax rebate on. How much can you claim for 2025 and 2025?

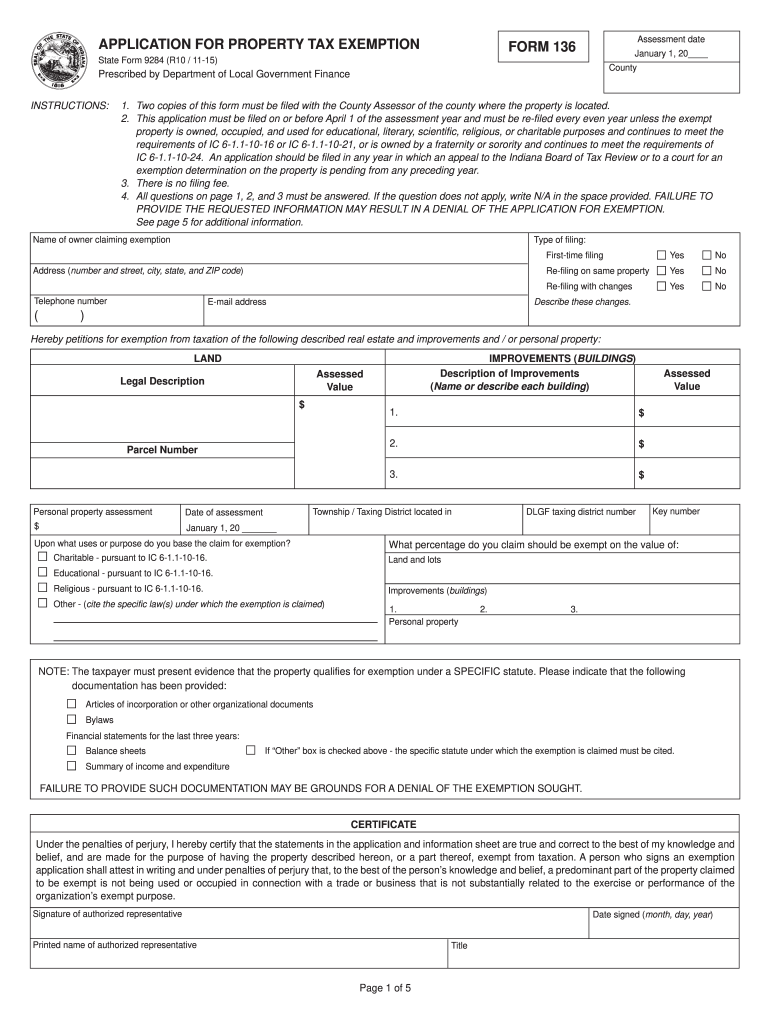

Form 136 indiana Fill out & sign online DocHub, How much can you claim for 2025 and 2025? This is due to the provision enacted in 2017 through the tax cuts and jobs act.

Vaccine medical exemption form Fill out & sign online DocHub, The maximum basic personal amount rose to $15,705 in 2025, capped at $14,156 for individuals with net income above $173,205. This is due to the provision enacted in 2017 through the tax cuts and jobs act.

The Standard Deduction and Personal Exemption Full Report Tax, This was hiked in last year's budget from rs 2.5 lakh by rs 50,000. Personal exemptions used to decrease your taxable income before you.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $13,850 for single and for those who are married, filing separately; How much is the standard deduction for 2025?

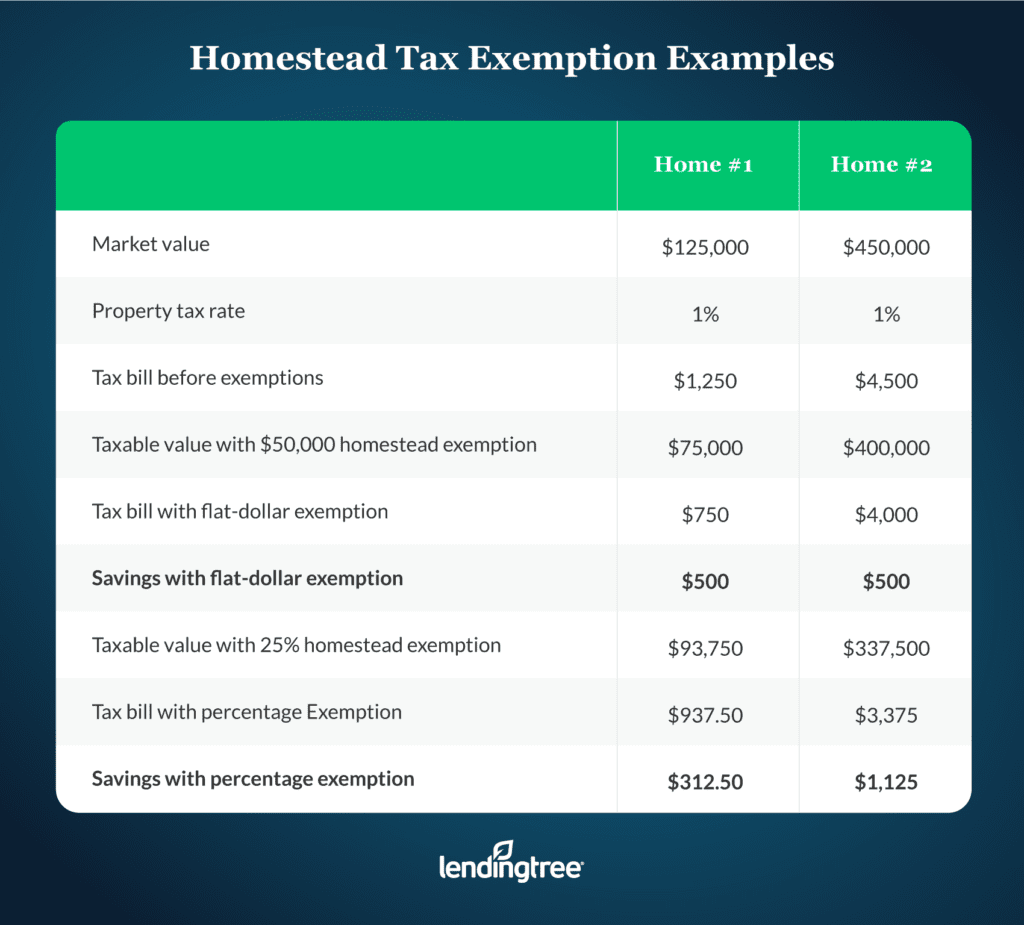

What Is a Homestead Exemption and How Does It Work? LendingTree, Currently, new tax regime has basic exemption limit of rs 3 lakh. Tax rebate up to rs.12,500 is applicable for resident individuals if the total income does not exceed rs 5,00,000 (not applicable for nris.

10+ Calculate Tax Return 2025 For You 2025 VJK, Basic exemption limit increased from rs. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $13,850 for single and for those who are married, filing separately;

Starting july 1, 2025, people earning less than $43,888 per year, or $844 per week, would be eligible for overtime pay.